Within this time it will have also incurred expenses of $9,000. In this example, it is assumed that there is just one expense account. Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. Companies are required to close their books at the end of eachfiscal year so that they can prepare their annual financialstatements and tax returns. However, most companies prepare monthlyfinancial statements and close their books annually, so they have aclear picture of company performance during the year, and giveusers timely information to make decisions.

Step 4: Calculate and Close Retained Earnings

With the use of modern accounting software, this process often takes place automatically. That’s why most business owners avoid the struggle by investing in cloud accounting software instead. Answer the following questions on closing entries and rate your confidence to check your answer.

Analyzing the opening trial balance:

And unless you’re extremely knowledgeable in how the accounting cycle works, it’s likely you’ll make a few accounting errors along the way. To close the drawing account to the capital account, we credit the drawing account and debit the capital account. Now for this step, we need to get the balance of the Income Summary account.

What is Qualified Business Income?

At the end of a financial period, businesses will go through the process of detailing their revenue and expenses. Why was income summary not used in the dividends closing entry? Only income statement accounts help us summarize income, so only income statement accounts should go into income summary.

- A sole proprietor or partnership often uses a separate drawings account to record withdrawals of cash by the owners.

- To determine the income (profit orloss) from the month of January, the store needs to close theincome statement information from January 2019.

- The balance in Income Summary is the same figure as whatis reported on Printing Plus’s Income Statement.

Dividend Accounts and Closing Journal Entries

Let’s explore each entry in more detail using Printing Plus’sinformation from Analyzing and Recording Transactions and The Adjustment Process as our example. The Printing Plusadjusted trial balance for January 31, 2019, is presented inFigure 5.4. Closing entries are an important facet of keeping your business’s books and records in order.

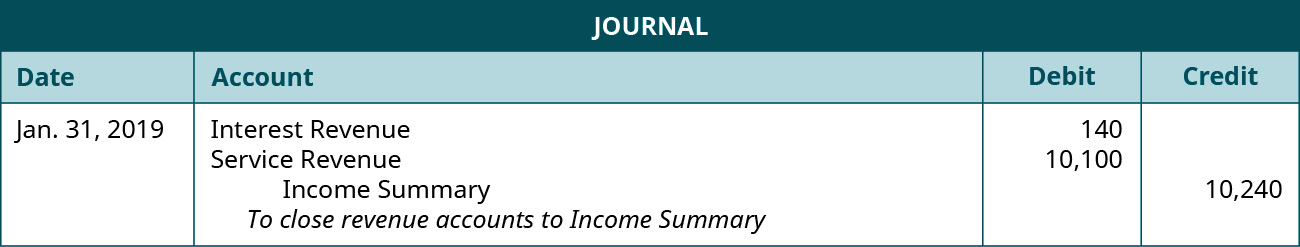

To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement.

Closing entries are the journal entries used at the end of an accounting period. Remember that all revenue, sales, income, and gain accounts are closed in this entry. Do you want to learn more about debit, credit entries, and how to record your journal entries properly? Then, head over to our guide on easily forecast and fund cash flow gaps journalizing transactions, with definitions and examples for business. Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship). Thus, the income summary temporarily holds only revenue and expense balances.

Temporary accounts are closed or zero-ed out so that their balances don’t get mixed up with those of the next year. The retained earnings account is reduced by the amount paid out in dividends through a debit and the dividends expense is credited. In essence, we are updating the capital balance and resetting all temporary account balances.

To get a zero balance in a revenue account, the entry will show a debit to revenues and a credit to Income Summary. Printing Plus has $140 of interest revenue and $10,100 of service revenue, each with a credit balance on the adjusted trial balance. The closing entry will debit both interest revenue and service revenue, and credit Income Summary.

![Hacked by Z-BL4CK-H4T [L4M]](https://kasaidcorlu.com/wp-content/uploads/cropped-logo_footer-2.png)