During the Houzzle Economic, i satisfaction ourselves into the offering the most total details about brand new Va Financial program in the market. I ask one to make use of this page since your self-help guide to learn as to the reasons an excellent Virtual assistant Loan will be the best option for your home buy or re-finance.

In the 1944, new U.S. bodies written an armed forces financing warranty program to assist returning solution users get property. The end result, this new Virtual assistant Financing, is actually a mortgage issued of the recognized lenders for example Houzzle Economic and secured by the government. Just like the their the beginning, the latest Va Loan program features aided put more 20 million experts as well as their families to your a reasonable a mortgage state owing to the type of masters over old-fashioned mortgage loans.

No cash Down

Today, the newest Va Mortgage system is more crucial than ever before so you’re able to service people. Recently, loan providers nationwide has tightened up its credit requirements regarding wake out-of brand new housing industry failure, deciding to make the Virtual assistant Mortgage a lifeline to have military individuals, lots of whom see challenge when up against difficult credit requirements and you will advance payment requirements.

As with any home loans, Va Mortgage loans provides big details and you may information to review. I at the Houzzle Financial prompt one to use all of our web site’s resources to educate yourself on the specifics of this personal financial work with. When you have then questions, we invite you to definitely name a Va Financing specialist within (770)897-Mortgage (5626) In addition.

Virtual assistant Financing versus. Old-fashioned Mortgages

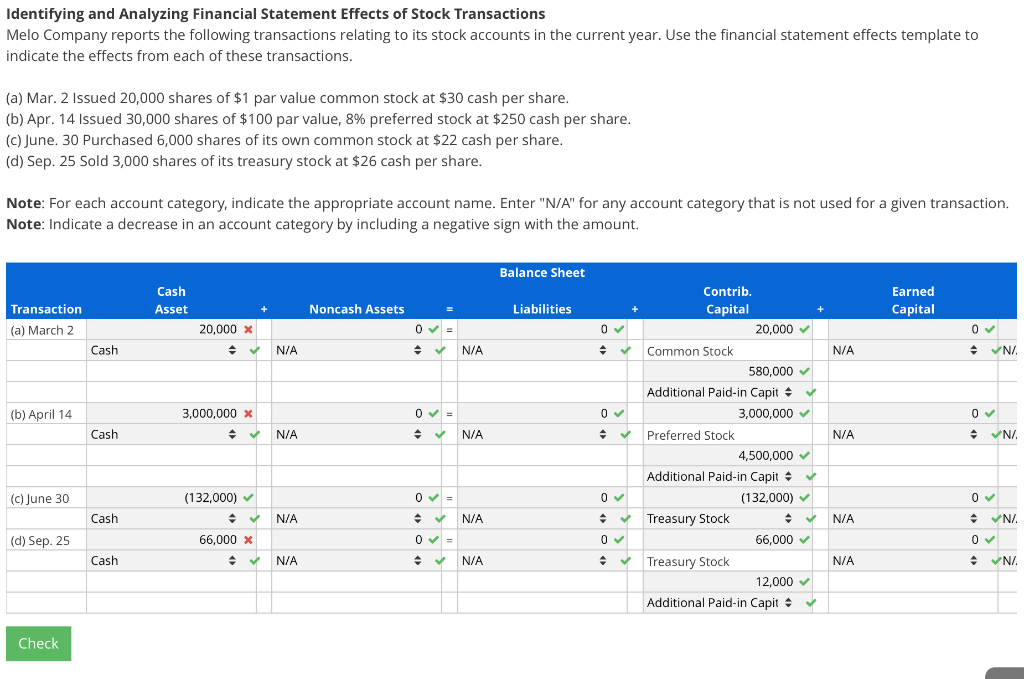

Armed forces homebuyers gain access to probably one of the most unique and effective mortgage programs actually written. See how the fresh Va Mortgage compares to a timeless mortgage:

Va Finance

Aggressive Interest levels. New Virtual assistant guaranty brings loan providers an increased amount of coverage and you can self-reliance, hence generally function a far more aggressive rates than just low-Virtual assistant loans.

Easier to Qualify Given that financing try supported by the us government, banking institutions assume reduced chance and have reduced strict certification requirements to possess Va Fund, causing them to easier to obtain.

Traditional Financing

Up to 20% Off Traditional fund fundamentally need off costs which can started to right up in order to 20% in order to safer a home loan, moving them out of reach for some homeowners.

PMI Required Private Financial Insurance is a significance of borrowers who financing more than 80% of the residence’s worthy of, tacking towards additional month-to-month expenditures.

Improved Chance having Lenders Instead of regulators backing, banking companies is taking on alot more chance and this, consequently, can lead to a less-aggressive interest in your home loan. Standard Qualification Tips Old-fashioned options hold stricter degree measures which can put homeownership unrealistic for many homebuyers.

Rules and Costs

Although the Virtual assistant Loan try a federal system, the government essentially will not build lead funds so you can experts. Rather, private lenders including Houzzle Monetary, finance the borrowed funds because Service of Experts Facts also provides a guarantee.

This guarantee, and therefore covers the lending company against full losses if the client standard, will bring added bonus for private lenders to provide loans which have top conditions.

Loan Limitations

In most places, pros just who be eligible for the Virtual assistant Financing can find a property worth to $424,100 instead placing anything down; however, to the 2017 Va Mortgage Limitations, individuals into the highest-prices counties ount as opposed to a down payment. To find out brand new Va Financing Restriction close by, contact us during the (770) 897-Financing (5626) or simply click on the Use Today option and one your Virtual assistant Expert will-call your quickly.

Investment Charge

The latest Va Resource Payment happens directly to this new Virtual assistant to be sure the application form has actually powering getting generations to come away from military homeowners from the removing any extra burdens away from taxation payers and you may pros. The price tag may vary with respect to the borrower’s facts and won’t get experts which have service-linked disabilities. Such, if this sounds like your first date by using the Virtual assistant Financial System, this new capital percentage is generally 2.15 percent of price of the property https://paydayloanalabama.com/sylacauga/. Having then access to your Va Loan benefit, the price tag is 3.step three %.

Va individuals can move the brand new financing percentage to their overall mortgage number. The fresh new Va along with limitations settlement costs to own experts and you can allows vendors to expend really otherwise all of those costs. Quite a few individuals buy a property without currency owed during the closure.