- Private finance

- Financial

- Automobile financing

- Insurance

- Cryptocurrency and NFTs

- Exactly how domestic equity finance work in Tx

- Calculate and you may examine Tx domestic guarantee mortgage or HELOC rates of interest

- Just how much can i acquire that have a property collateral loan?

- Exactly how HELOCs work in Tx

A property collateral mortgage makes you borrow against the significance of your house. Extremely borrowers explore home guarantee funds to have higher purchases such as home improvements, buying yet another family, scientific debts otherwise educational costs.

Just how family security money work with Colorado

Domestic guarantee money can be found in a lump sum therefore make fixed monthly obligations towards loan’s life. The term might be from around four in order to thirty years, according to the loan amount.

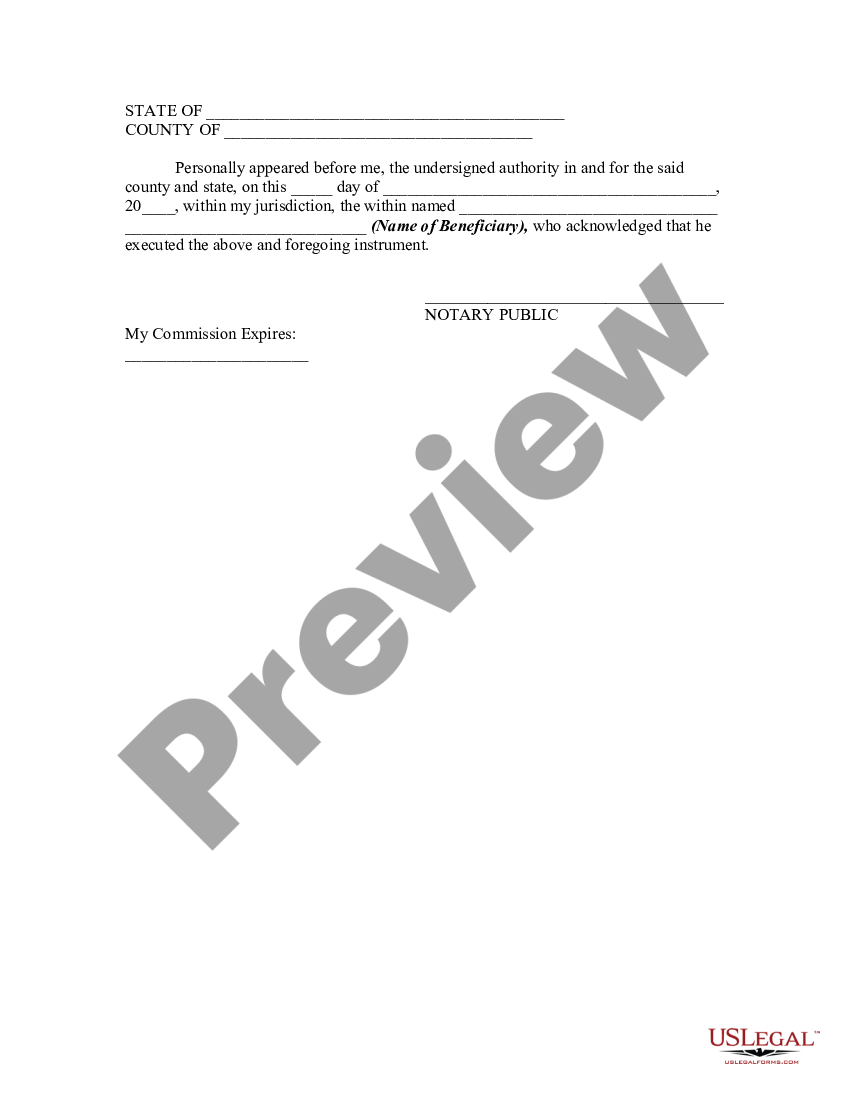

Texas don’t make it household collateral fund up to 1997, and has house equity financial support statutes that do not connect with almost every other states. The us government lay these in place to attenuate good homeowner’s chance off foreclosures and you can cover consumers.

Determine and contrast Colorado house security mortgage or HELOC rates

Fool around with the equipment to track down customized estimated rates away from ideal lenders considering where you are and you may monetary facts. Find regardless if you are in search of a house Security Mortgage otherwise a good HELOC.

Discover household security financing or HELOC, get into your own Area code, credit score and you may information regarding your where you can find see your personalized costs.

How much cash ought i borrow having a home security financing?

So you can calculate how much you could potentially borrow having a home equity mortgage when you look at the Tx, you have to know several key something:

Is eligible for a home collateral financing, need enough family collateral – constantly no less than 20%. Collateral is the difference in your own residence’s appraised worth plus an excellent equilibrium with the mortgage.

Like, say you reside respected on $150,000 while owe $100,000 on your mortgage, meaning you have in all probability as much as $50,000 home based equity. You will be permitted to obtain doing 80% of residence’s really worth.

To own a $150,000 family, 80% is $120,000. Now i subtract the $100,000 financial equilibrium regarding $120k, and you may we are left towards the amount you could obtain contained in this example: $20,000.

Exactly how HELOCs are employed in Texas

HELOCs from inside the Texas work much like household collateral financing. Tx rules requires that all HELOCs enjoys a max loan-to-well worth proportion from 80%, definition you could potentially use as much as 80% of one’s house’s appraised worth. Colorado rules and additionally says that your particular domestic equity personal line of credit need the absolute minimum draw from $4,000.

The advantage that have HELOCs is that you can mark currency given that expected, up to the most amount borrowed. Most HELOCs include a draw several months you to lasts a decade, and an installment period of up to twenty years.

With HELOCs you pay desire toward amount you’ve lent inside mark several months, and you will lso are-borrow the money as required – just like how you would fool around with a credit card.

How bucks-aside refinance funds are employed in Texas

A finances-aside refinance loan substitute your existing home loan with a brand new, larger financing, allowing you to take out money in the type of collateral. Inside Texas, a finances-away re-finance is also entitled a section 50(a)(6) financing.

Eg, if for example the home is worth $100,000 and you are obligated to pay $70,000 on your home loan, you’ve got $29,000 in home collateral. If you got away a finances-away refinance loan getting $80,000, you’d located $ten,000 for the bucks at closure.

How to get a knowledgeable speed from inside the Colorado

With one of these resources may help improve your odds of qualifying to own a lowered rate towards the a property collateral mortgage into the Tx.

Solution funding to have Texans

If not believe it is possible to be eligible for a property https://paydayloansconnecticut.com/suffield-depot/ collateral mortgage inside the Texas – or if you only should not chance foreclosures – you’ll be able to evaluate these choices.