Daina B. was a talented article writer with a talent to have examining Us housing market manner. Her clear and you will entertaining posts support clients navigate the causes away from buying and selling services.

Carol C. was an adaptable publisher, skillfully polishing a property quite happy with precision and you may development. You should definitely investigating markets manner, the woman is engrossed regarding the enthralling realm of new movies.

?? Editor’s Mention: Agent Connections, agencies, and you will MLS’ have begun implementing changes pertaining to this new NAR’s $418 million payment. Whenever you are home-manufacturers may save your self plenty inside the percentage, conformity and you will legal actions threats possess rather improved having manufacturers in the nation. Discover how NAR’s payment influences homebuyers.

Up to 83% off home buyers fool around with FHA funds to shop for their dream domestic. Has just this new FHA loan limitations have increased by $26,000. According to the revised rule, new FHA mortgage limit to have solitary-home buyers is $498,257 for the majority areas. While into the large-cost areas brand new restriction can are as long as $step one,149,825.

These the fresh new flexible constraints and low-down commission out of step three.5% make FHA financing a convenient option for your payday loans online Hawai. FHA financing also offer a more lenient credit rating from merely 580 versus old-fashioned money.

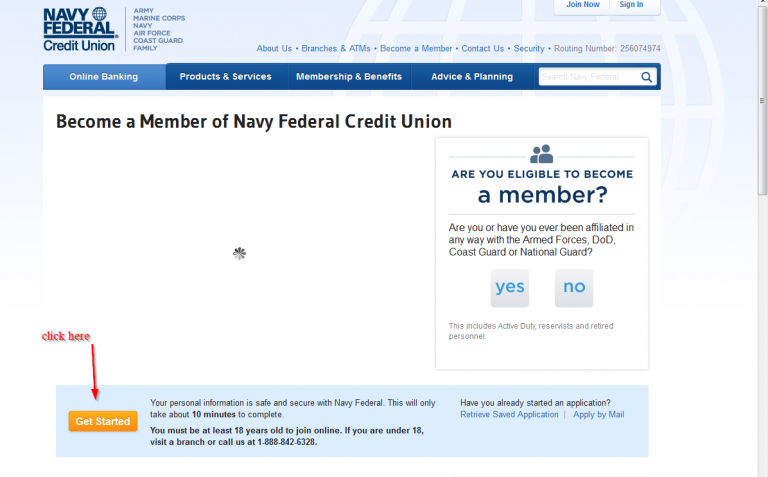

You can use elite lender’s assistance to locate FHA fund. They assist simplicity the procedure and you can schedule. Start right here! Get a hold of lenders online.

2024 FHA Financial Needs

They supply versatile advice getting consumers who will most likely not take advantage of conventional money. Here are the the best thing as ready to accept:

- Deposit: You ought to have the very least advance payment out of 3.5%. Observe how which deposit usually apply to their monthly installments, you need to use a home loan calculator to greatly help bundle your allowance.

- Credit history: You should have the absolute minimum credit score from 580 in order to take advantage of an enthusiastic FHA mortgage. Individuals that have a credit history regarding five hundred so you’re able to 579 may still qualify but will have to pay a down payment of ten%.

- Mortgage Insurance premium: You have to pay an upfront level of step 1.75% of the loan amount. You might pay the number a-year or separate they into the days.

- Earnings and you will Employment Background You ought to have a two-season stable a career and you may income record.

- Debt-To-Income Ratio (DTI): You need to aim for a beneficial DTI ratio off 43% otherwise reduced. Particular lenders may ensure it is as much as fifty% for those who have a powerful credit rating or nice offers.

- Occupancy: FHA funds are merely approved for no. 1 home rather than getting investment motives.

- Home Appraisal: FHA-approved appraisers have a tendency to assess their house’s really worth. They look at whether or not it suits lowest cover and you will top quality requirements.

How to locate Your FHA Financing Limitation?

The newest Agencies out of Property and you may Metropolitan Development (HUD) set limits on FHA loans. They use several factors to assess financing constraints: the sort of property you will be buying therefore the urban analytical town it’s situated in.

Exactly how Is FHA Financing Limitations Computed?

While you are such restrictions are ready by HUD, it isn’t an individual repaired amount, they vary based on this type of points:

Tips to Shop for an enthusiastic FHA Loan

Try this advice to strategy your FHA loan look confidently. Find the best financing solution and also make the homeownership an actuality.

Summation

FHA mortgage restrictions vary ranging from areas considering its median family selling speed. The fresh new FHA studies its restrictions every year. They revision them predicated on industry criteria.

When you’re a first-big date home visitors you need to know the fresh new constraints in for the fresh season and you may area you are interested in. You truly must be wishing with your files and maintain the very least credit history from 580.

If you are looking having a decreased down payment mortgage and don’t have the better credit scores, a keen FHA financing helps you. Understand the assistance and requirements that come with these types of money.