Borrowing from the bank Guidance and Credit score Standards

USDA funds provides rather flexible borrowing from the bank advice, and you can qualify that have a credit score because the low because the 620. However, it is very important note that their interest will be high if your credit score try lower than 680.

In which is USDA home loans available?

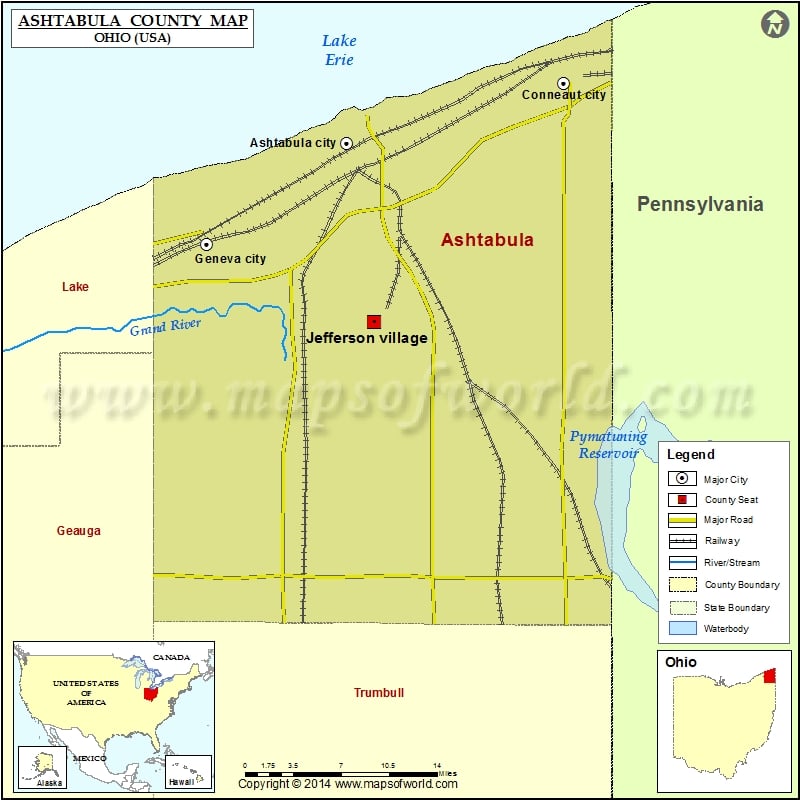

USDA mortgage brokers come in 97% of United states, and Corpus Christi. The property have to be situated in a specified rural town for the buy so you can be considered. Becoming sensed “rural,” a location typically has a population of thirty-five,000 or quicker.

Rural development financing

USDA money try mortgage loans supported by the You.S. Department regarding Farming as an element of its Rural Innovation Guaranteed Homes Mortgage program. USDA money are around for home buyers that have low-to-average income. They offer financing and no https://paydayloansconnecticut.com/tokeneke/ downpayment, reduced home loan insurance policies, and you may less than-sector home loan costs.

Qualified area chart and you may Rural areas

The new USDA have appointed certain specific areas as “rural” with the purposes of the borrowed funds program. You can check out new USDA web site to find out if your house is found in an eligible town.

Were created land and unmarried-family unit members belongings

USDA fund can be used to buy each other are made homes and single-nearest and dearest property. However, there are several restrictions you to definitely apply. Were created house have to be the latest, and they should be permanently affixed so you’re able to a charity.

Are there unique rules for Texas USDA loans?

There aren’t any unique legislation for Colorado USDA loans. Yet not, it is essential to note that the house or property should be based in a specified outlying area to qualify.

Other companies

In addition to the USDA loan system, there are many applications readily available that will help together with your pick. Texas has numerous very first-big date home buyer direction apps and you may debtor options. Such as, new Texas State Sensible Property Agency (TSAHC) now offers a program known as House having Tx Heroes Home loan Program. This program provides a thirty-12 months fixed speed home loan so you can eligible armed forces professionals, pros, very first responders, and you will educators.

FHA funds in the place of USDA financing

It can be confusing looking to understand what kind of financing is right for you. Even though many buyers be aware that a normal financing isn’t the best method, they could never be yes what other possibilities might possibly be better. Like, FHA money versus USDA money.

FHA funds, like USDA financing, is supported by the government as well as have benefits. But not, there are many secret distinctions that you ought to consider, for example:

When you compare FHA loans and you will USDA financing, it is essential to keep in mind that FHA funds are available to all individuals, no matter whether or perhaps not he or she is looking to buy a good possessions during the a rural town. USDA fund are just open to individuals who’re trying to purchase a home from inside the a designated rural city.

Wanting USDA financing professional

When you find yourself looking providing a great USDA loan into the Corpus Christi, it is vital to find a specialist who’ll help you as a consequence of the method. A great USDA loan expert will be able to answer every one of your questions that assist you have made pre-accepted for a financial loan. Colorado United Financial has experienced mortgage lenders who see the USDA system and will help you secure that loan.

Pre-Recognition for a great USDA financing

The first step in enabling a USDA mortgage is to obtain pre-accepted. This course of action allows you to determine if you happen to be entitled to an effective USDA financing and you may what type of property you can buy.

Knowledge USDA investment

USDA financial support should be confusing, but coping with good USDA mortgage pro may help improve process convenient. A beneficial USDA loan pro should be able to answer each of the questions you have on the conversion process speed and appraised worth in order to closing will set you back and you may everything in anywhere between.

Start off Today

If you find yourself shopping for getting an effective USDA loan in Corpus Christi, it is essential to look for a loan provider who can make it easier to due to the procedure. An effective USDA mortgage expert can address all of the questions you have that assist you get pre-acknowledged for a loan.