Because you navigate during your personal fund journey, the option of delivering that loan out of your Thrift Discounts Package (TSP) can get happen. While you are a tsp mortgage can offer a way to obtain financial support, it’s imperative to enjoys an extensive understanding of the procedure and implications before carefully deciding. Contained in this blog post, we’re going to defense 7 trick concerns to assist you make a knowledgeable alternatives when considering a tsp financing.

Would We Qualify for a teaspoon Financing?

Being qualified to have a teaspoon financing is fairly simple. As your individual financial, the prerequisites are minimal. You need to be already doing work in the us government otherwise army, has actually no less than $step one,000 on your Teaspoon membership out of your efforts and you can related income, not have fully paid off a previous Teaspoon loan during the last a month, and also zero unsatisfied legal commands facing your bank account. The good thing? There are not any borrowing monitors, and you can borrowing won’t apply to your credit score.

Just what are My Financing Options?

There’s two sort of Teaspoon funds: general-purpose funds and you can no. 1 household funds. General purpose funds can be used for one you want versus files and its installment several months can one 5 years. On top of that, number one residence finance is purely for buying otherwise building the majority of your home and its repayment several months try 5 to help you 15 years. Paperwork demonstrating the purchase will cost you or build will set you back of one’s the new domestic must be registered in this thirty day period of one’s loan demand.

You could potentially only have two financing at the same time. You can feel a standard objective mortgage plus the most other a good primary house financing, or you can features one or two general-purpose money in addition. But not, you can not possess a couple prie big date. When you have each other a civilian and a military account, these types of limits use individually every single Tsp membership.

How much Must i Obtain?

You can simply borrow funds that’s committed to the brand new TSP’s key loans and you will lifecycle money. The minimum you might borrow is $1,000, toward restrict capped in the $fifty,000 otherwise shorter, according to your own efforts and you may earnings. The lent number is distributed proportionally from the traditional and you will Roth stability on Tsp membership.

What are the Interest levels and you will Can cost you?

Teaspoon money function apparently reduced will set you back, that have interest levels tied to the new G Fund’s speed of get back. Their interest rate will continue to be repaired toward life of brand new mortgage. Discover limited costs off $fifty to possess general-purpose financing and you may $100 to own number one home funds. This type of charge was subtracted straight from the borrowed funds count. Since the head costs are reasonable, it is in addition crucial to check out the secondary costs of possible shed funding development on lent count.

How ‘s the Teaspoon Financing Reduced?

Tsp financing try reduced due to payroll deductions, guaranteeing a hassle-free techniques. You may also generate even more payments to clear the loan reduced, without punishment having early repayment. Think about, for people who key jobs otherwise exit work, you need to would loan costs appropriately to end tax ramifications.

How can i Sign up for a tsp Financing?

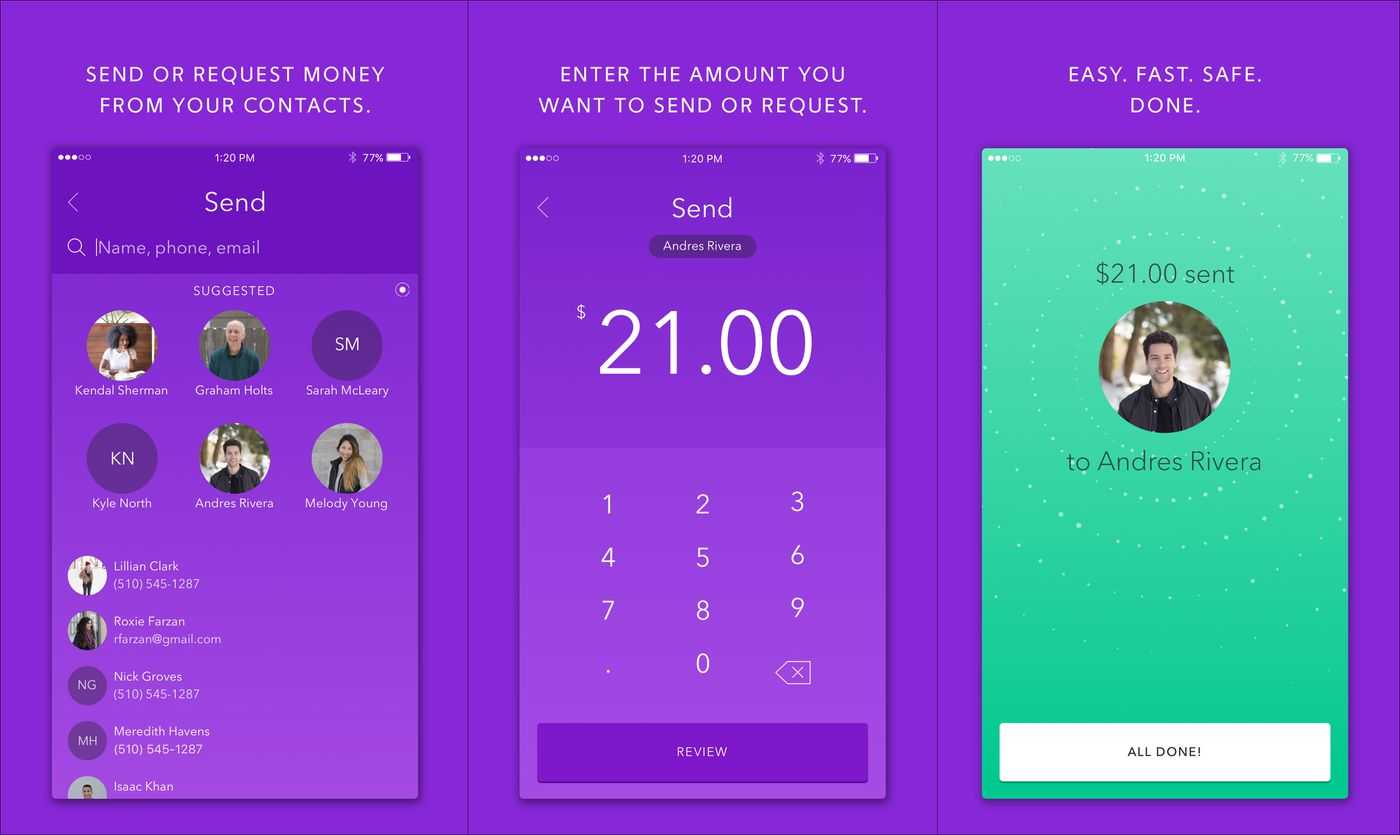

Applying for a teaspoon financing are simpler through the on line site. Spousal agree needs for partnered somebody, however, repayment remains the borrower’s obligations. Shortly after accepted, fund are generally disbursed within three working days thru lead deposit.

Should i Take a loan from My Tsp?

Choosing whether to get a teaspoon loan are an individual options. When you yourself have most other money readily available for your needs, it is smart to explore one basic to avoid affecting pension deals. When you yourself have pretty good borrowing, wanted lowest costs, and will pay the mortgage, a teaspoon loan could work to you. Believe just how secure your task is actually as well as how much time you want to remain in the federal government or armed forces before borrowing. Making with a great financing may lead to significant taxation.

We hope you liked this post. If you have any questions otherwise issues about federal advantages or later years considered, apply at united states. Here’s a few from ways in which we could help:

- Book a free forty-five-moment appointment that have a great Fedway Economic Advisor.

- Subscribe to all of our YouTube Route The money Briefing to locate insightful posts regarding the federal pros and you may later years considered.

Jerel Harvey

Jerel Harvey ‘s the Creator and you may Managing Principal away from Fedway Economic, an advisory business that provides monetary thought, resource government, and masters education for the government team.